UPDATE: 9/17/07: On the first day of the DiBruno's trial, shortly before jury selection, all three DiBruno's decided to enter plea agreements and await sentencing.

- Joseph DiBruno Sr.'s Plea Agreement

- Joseph DiBruno Jr.'s Plea Agreement

- Nick DiBruno's Plea Agreement

- Government's Exhibit List

- Second Superseding Bill of Indictment

For the past twenty years, the DiBruno family from Belmont, NC have scammed hundreds of people out of tens of millions of dollars.

For the past twenty years, the DiBruno family from Belmont, NC have scammed hundreds of people out of tens of millions of dollars.The DiBruno's made a living taking advantage of the elderly, inexperienced investors and their friends. They are ruthless con-artists who have knowingly defrauded people out of their life savings to treat themselves to expensive cars, homes and jewelry.

I could not possibly list all of the scams the DiBruno’s have been involved in over the years but I promise you will get the idea if you read the following…

Joseph DiBruno, Sr. and his wife Lela DiBruno established the family criminal enterprise in the early 1980's. Joe DiBruno partnered up with some fellow crooks in 1983 to create a bogus company called 'National Gas & Power Co.' or 'NGP.' DiBruno and his co-conspirators told potential investors they operated a successful recycling plant in Virgina and planned to expand.

DiBruno produced false documentation to mislead potential investors into believing there was a company and recycling plant to invest in. He presented them with false profit information and had his cohorts act as satisfied investors to further convince the investors. After DiBruno and his cronies convinced people to invest in NGP and collected the money, they did not provide any further financial information to the ‘shareholders’ of NGP. In addition, none of the parties involved in selling the stocks were licensed security agents.

NGP was subsequently shut down by the SEC in 1989. DiBruno was convicted of security law violations but he never paid a cent to the victims he defrauded nor did he spend one day in jail for his crimes. The SEC violations didn’t stop DiBruno. This was only the beginning of his career in cheating people out of money.

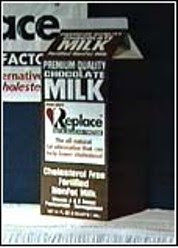

DiBruno had a partner in crime named Cecil Minges. Minges was an older man and a veteran con artist himself. Minges formed a fake company in Florida called 'US Dairy.' He claimed he had the recipe for low cholesterol milk and bilked investors out of millions of dollars before US Dairy was shut down by the SEC in 1994.

Two months after Minges' company US Dairy was shut down, DiBruno formed a corporation in North Carolina called 'Golden Jersey Products' or GJP. DiBruno formed the 'shell' business to continue Minges' milk scam; however, DiBruno, Sr. took it to the next level. Joseph DiBruno informed potential investors he could buy the formula for cholesterol free milk for $2.5 million dollars. The formula was supposedly called 'Replace' and the product was to be called 'Dairy Trim.'

Two months after Minges' company US Dairy was shut down, DiBruno formed a corporation in North Carolina called 'Golden Jersey Products' or GJP. DiBruno formed the 'shell' business to continue Minges' milk scam; however, DiBruno, Sr. took it to the next level. Joseph DiBruno informed potential investors he could buy the formula for cholesterol free milk for $2.5 million dollars. The formula was supposedly called 'Replace' and the product was to be called 'Dairy Trim.'DiBruno had the audacity to send out press releases and have a press conference announcing his new milk product. DiBruno’s announcement appeared on CNN and in the NY Times to promote a product he didn't even have the formula for. DiBruno promised his investors a huge return on their investments and once again produced fake documentation to coax his victims into investing in the company. In addition, he had his co-conspirators on hand to act as the enthusiastic investors again.

Joe DiBruno, Sr., his criminal cohort, Cecil Minges, and his eldest son, Joe DiBruno Jr., printed piles of worthless GJP stock certificates and sent them to investors. Overall, the DiBruno’s sold 10 million shares of phony GJP stock. The list of GJB shareholders (victims) includes 350+ people.

The sad part is that DiBruno was in fact offered a cholesterol free milk formula for $2.5 million dollars; however, he never paid for it nor did he plan to. DiBruno never made any effort to buy the formula or take the steps necessary to bring the milk product to market.

In 1999, a group of investors from Florida filed a complaint against Joseph Sr., Golden Jersey Products and two co-conspirators. The investors claimed they were defrauded when they purchased GJP stock. Around the same time, the IRS filed a tax lien against the DiBruno's home in Florida for the amount of $969,027. Joe DiBruno Sr. and Lela DiBruno quickly filed for a sham divorce to protect their assets. It wasn’t until 2002 when Golden Jersey Products sent a memo to shareholders advising them GJP was bankrupt.

Joe DiBruno, Sr. and his cohorts continued the cholesterol free milk scam until the late 90's until they thought of a new scam…They invented a company who supposedly had the rights to a product had called "Immuno-C." Immuno-C was a Vitamin-C filled, chewable, tangerine flavored product with colostrum. As usual, the DiBruno's did not have a product nor did they have any intent to sell any product. It was all about selling fraudulent stock to pocket all the money.

Joseph DiBruno Jr. (Photo R) and Nicholas DiBruno starting working with their con-artist parents in the late 90's. By the year 2000, the DiBruno brothers were actively participating in the family scam business. Joe DiBruno Jr. incorporated at least nine different companies in the state of North Carolina in 2001.

Joseph DiBruno Jr. (Photo R) and Nicholas DiBruno starting working with their con-artist parents in the late 90's. By the year 2000, the DiBruno brothers were actively participating in the family scam business. Joe DiBruno Jr. incorporated at least nine different companies in the state of North Carolina in 2001.In 2000, Joseph DiBruno Jr. created a company called Internet Business Design Group or IBD. Joe Jr. & Nick DiBruno scammed a South Carolina woman to invest in the non-existent IBD and promised her big returns. In 2002, the victim filed a lawsuit against I.B.D Group, Inc., Joseph DiBruno Jr. and Nicholas DiBruno. In 2003, the SC courts awarded the victim $74,500.

Another shell company DiBruno Jr. incorporated in 2001 was called 'DiBruno Brothers Mining, Inc.’ The father and sons team claimed they were part of Knights of Malta and had certain mineral rights on government land in New Mexico. They were supposedly working with the Knight of Malta to mine for gold and bring "hope and nourishment to millions of children around the world." They presented investors with fake land surveys and even went so far to forge an insurance policy from Lloyds of London guaranteeing the mine to be worth $500 million dollars!

In 2003, Joe Jr. and Nick DiBruno solicited people to invest in a company called "IFT" or International Food Technologies, Inc. The DiBruno brothers told potential investors their father was a nutritional scientist who started IFT and had developed a flavored milk product containing the sucralose sweetener "Splenda."

The DiBruno’s claimed the drink was healthier than a sugar sweetened drink and the product was intended for sale in schools throughout the United States. They gave false profit information to investors and continued to solicit them for more money. The DiBruno's told the investors the investment would profit 400%. One of the scam victims from Indiana sued the DiBruno's in 2004.

At the same time, the DiBruno's and Cecil Minges were busy persuading people to invest in their fake record company called KB Records. The men told potential investors they had signed a contract with a talented singer named Jody Lee Hage and Sony Records wanted to buy the rights to his songs for $20 million dollars. According to Hager, he lived with the DiBruno's for over a year and was paraded around completely naive to the fact the DiBruno’s were scamming him too.

In 2004, two scam victims hired a private investigator from Florida to research the DiBruno family so they could bring the case to court. The pair decided it was high time to put an end to the DiBruno family scams and see to it that justice is done. The private investigator thoroughly researched the DiBruno’s and he was able to gather enough information to put together a 586 page report to submit to the US Attorneys Office, IRS, The Securities and Exchange Commission and the Florida Division of Securities.

The DiBruno family knew they were going down and vowed their victims would never see a cent so Joseph DiBruno, Sr., Joseph DiBruno, Jr and Nicholas Dibruno all filed for bankruptcy. This was a big mistake because they were basically inviting government to look at their financial situations. Of course, the DiBruno’s did what they do best and lied on the bankruptcy filing paperwork. The family failed to include many assets and it came back to bite them.

In November of 2006, Joseph DiBruno, Sr. and his two sons were FINALLY indicted in Federal Court on charges of money laundering, securities fraud, frauds & swindles, concealing assets & defrauding the United States. Joseph DiBruno Jr. is charged with numerous additional counts of wire fraud, mail fraud, promotion of money laundering, concealment of assets and conspiracy.

Joseph DiBruno & Nicholas DiBruno were released from jail but Joseph DiBruno, Jr. remains in jail. He filed a petition for release from jail pending a trial but his petition was denied.

I hope the DiBruno boys go away for a long time! For some reason, Lela DiBruno was not indicted. She was involved in the scams and profited from them so hopefully she will be charged as well.

Links:

- Indictment: US-v-DiBruno (11/06)

- Case History: US-v-DiBruno (11/06)

- Private Investigator Case File